26+ Mortgage calculator no pmi

To show you how this works lets compare two 30-year fixed mortgages with the same variables. 24 payments a year.

Best Mortgage Refinance Rates Of 2022 Lendstart

3006 second mortgage.

. You may think 50 or 100 a month is a small sum but no amount is too small. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. No second mortgage no home equity loan.

A 15-year FRM has 180 payments spread throughout 15 years. Meanwhile for a 30-year FRM there are 360 payments spread across 30 years. For conventional loans a borrowers down payment must exceed 20 of the homes price to avoid PMI government-backed mortgages such as a VA or FHA loan are exempt from this if you are.

When a buyer decides to. PMI is an extra cost thats around 05 1 of your annual loan amount. Borrowers who obtain a conventional mortgage and put less than 20 down are often required to pay for property mortgage insurance PMI.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel. Additional mortgage payments have the biggest impact during the first years of the loan. Second mortgage types Lump sum.

But with a bi-weekly mortgage you would make 26. Private mortgage insurance also called PMI is a type of insurance policy that protects lenders from borrowers defaulting on their mortgage. Use this free mortgage calculator to get a side-by-side view of multiple loan quotes to select the best offer.

Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. However there are 52 weeks in a year if you are making biweekly payments you will end up making 26 payments a year. Across the United States 88 of home buyers finance their purchases with a mortgage.

The Texas Mortgage Credit Certificate provides qualified borrowers with up to 2000 per year in a federal income tax credit based on mortgage interest paid in the tax year. Second mortgages come in two main forms home equity loans and home equity lines of credit. Private mortgage insurance also.

Whatever extra you pay today is extinguished debt not accruing any further interest forever. Depending on the home you may also have condo association or homeowners association HOAdues though these are paid separately from your monthly mortgage bill. 30-Year Fixed Mortgage Principal Loan Amount.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. NerdWallets early mortgage payoff calculator figures out how much more to pay. This is a monthly fee which is in addition to the typical loan payment.

PMI accounts for 05 percent to 1 percent of your loan amount per year. By the end of the mortgage term in the year 2033 by contrast the interest payment would be only 189 and the principal would be a whopping 41187. The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf.

We used the calculator on top the determine the results. Private mortgage insurance is a percentage of the loan amount. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year.

Use this simple online mortgage calculator to easily estimate your monthly mortgage payment interest rates and taxes. Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

Applicants must be first-time homebuyers and must meet income and purchase price limits. This printable amortization schedule will help you to get a month by month calendar of exactly how much of your monthly income will be devoted to paying off your mortgage. 8 Ways To Get A Mortgage Approved And Not Mess It Up May 26 2016 4 ways to keep your mortgage closing costs low June 22 2017 USDA eligibility and income limits.

The extra payments. The loan is secured on the borrowers property through a process. Fannie Mae HomePath mortgage.

Private mortgage insurance PMI can be a tricky subject so we broke down what PMI insurance is how much it costs and whether its the right option for you. Assuming you always pay on time your mortgage should be paid off within the agreed term. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

You can use the above calculator to generate a sample amortization schedule. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Pay half a mortgage payment every two weeks. 2022 USDA mortgage May 17 2022.

15-year loans build home equity faster whereas 30. For each quote you can select different rates terms points origination fees closing costs. When you take out a mortgage to purchase or refinance a home youll likely be required to pay for mortgage insurance.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. You make 26 half-payments equivalent to 13 full payments a year. This is because the principal or outstanding balance is larger.

This cost is often rolled into your monthly mortgage payments. Financial advisors recommend making a 20 down payment on your mortgage. Use SmartAssets free Pennsylvania mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

Private mortgage insurance PMI is separate from homeowners insurance if you input a down payment of under 20 in our calculator youll have a PMI estimate as well. Interest Rate - Interest rate for your mortgage. Besides reducing your monthly payments and boosting your interest savings paying 20 down eliminates private mortgage insurance PMI on a conventional loan.

Private Mortgage Insurance PMI Borrowers who take conventional loans must pay private mortgage insurance if their downpayment is less than 20 percent of the homes price.

Usda Mortgage Insurance Premium Mortgage Loans Usda Loan Mortgage

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Fha Mortgage Credit Score Mortgage Loans

Mortgage Insurance Vs Life Insurance Mortgage Protection Insurance Life Insurance Policy Life Insurance Companies

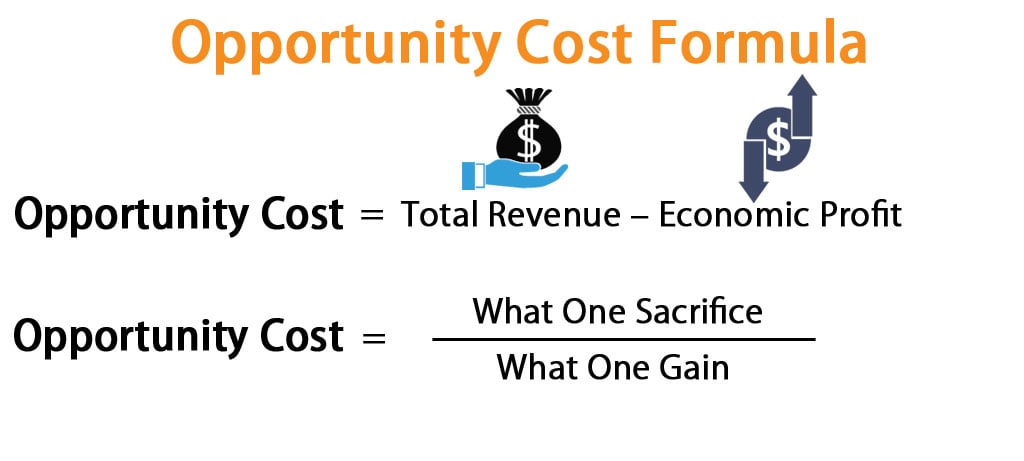

Opportunity Cost Formula Calculator Excel Template

First Time Homebuyer Mortgage Checklist In 2022 Mortgage Checklist Home Buying Home Buying Checklist

Funny Friday S Tgiff After The Last Fiasco Friday Humor Mortgage Humor Funny Friday Memes

Mortgage Insurance When Is It Required Mortgage Protection Insurance Refinance Mortgage Private Mortgage Insurance

Millions Of Veterans Have Already Used This Benefit See What The Va Loan Can Do For You Mortgage Loans Va Loan Refinance Mortgage

![]()

Blog2021 Archives Dessign Best Gutenberg Wordpress Themes

Best Mortgage Refinance Rates Of 2022 Lendstart

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Open Access Loans For Bad Credit Dating Bad Credit

![]()

Blog2021 Archives Dessign Best Gutenberg Wordpress Themes

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing

2020 Kentucky Va Mortgage Guidelines Mortgage Lenders Mortgage Va Mortgage Loans

Pro Forma Financial Statements Uses Of Pro Forma Financial Statements

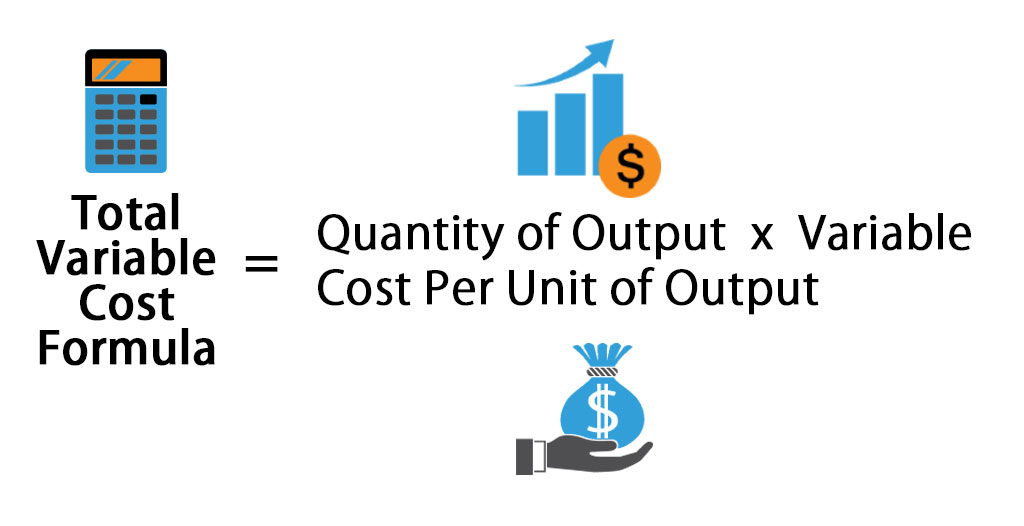

Variable Costing Formula Calculator Excel Template