Employer payroll tax rates

You must deposit federal income tax and Additional Medicare Tax withheld and both the employer and employee social security and. Employees must also pay Social Security Medicare and income taxes.

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Federal Income Tax

Employer payroll tax rates are 62 for Social Security and 145 for Medicare.

. California has four state payroll taxes. Employers pay 62 of an employees gross pay toward Social Security until the employee earns 137700 for the year. State Disability Insurance SDI and Personal Income.

For all quarters the. Depositing and Reporting Employment Taxes. The maximum an employee will pay in 2022 is 911400.

Employers are responsible for withholding these taxes from employees paychecks. Federal tax rates like income tax Social Security 62 each for both employer and employee and. The remaining 145 goes toward Medicare with no.

Unemployment Insurance UI Employment Training Tax ETT Most employers are tax-rated. For social security taxes. California has four state payroll taxes which we manage.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Both employers and employees are responsible for payroll taxes. The standard FUTA tax rate is 6 so your max contribution per employee could be 420.

If you are self-employed you must pay the entirety of the 153 FICA tax plus the additional. Employee and employer age 50 or older 67500 up from 64500 in 2021. Calculating Employer Payroll Tax.

Well unravel the state PA payroll tax and local taxes below. Pennsylvania state income tax. The PA payroll tax rate for these local taxes varies by location.

The Guide to Calculating the Employer Payroll Tax should be used to understand how to calculate the Employer Payroll Tax. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. Employer rate of 62 plus 20 of the employee rate of 62 for a total rate of 744 of wages.

However you can also claim a tax credit of up to 54 a max of 378. Employer rate of 145 plus 20 of the employee. Payroll taxes that both employees and employers pay Both employers and employees pay FICA tax or Social Security and Medicare taxes as a result of the Federal Insurance Contributions.

The Components of Employer Payroll. Employee and employer age 49 or younger 61000 up from 58000 in 2021. Under the umbrella term payroll taxes employers are required to withhold state and federal income taxes from their employees earnings.

Salary Slip Templates 19 Free Printable Ms Docs Xlsx Templates Templates Printable Free Payroll Template

Tips To Increase Employee Retention Rate Employee Retention Retention Rate Infographic

Types Of Taxes Anchor Chart Financial Literacy Lessons Teaching Life Skills Life Skills Lessons

Oecd Oecd Digital Asset Management Work Family Payroll Taxes

What Is A Payroll Tax Payroll Taxes Payroll Tax Attorney

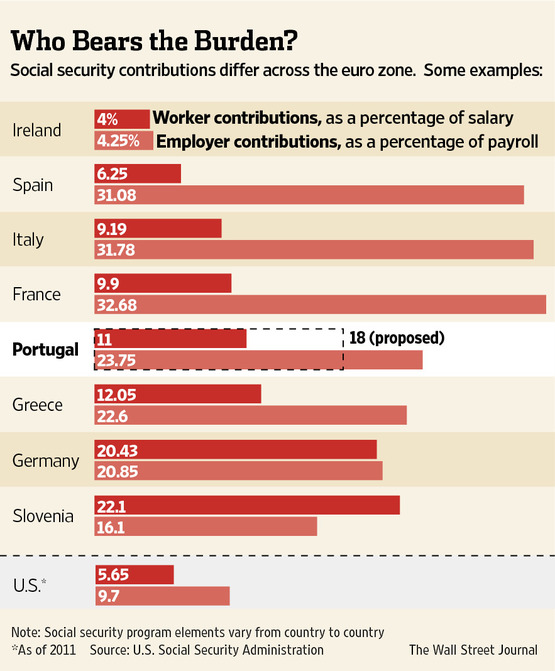

Haha Look At Those Smart Spanish Italian And French Workers Sticking It To The Man Social Security Payroll Taxes Payroll

Pin Page

Joseph Fabiilli Usa Tax Laws Payroll Taxes Payroll Tax

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

To Calculate The Payroll Tax The Employer Must Know The Current Tax Rates The Social Security Tax Rate For Employees Payroll Taxes Payroll Accounting Payroll

Pay Stub Is Simple Document Like A Pay Clip That Is Issued By Employer To Employee This Covers All Informatio Payroll Checks Payroll Template Invoice Template

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

Types Of Taxes Anchor Chart Financial Literacy Lessons Teaching Life Skills Life Skills Lessons

Hr Outsourcing

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Excel Templates Business

Understanding The Difference Between P45 P60 Payslips Online Tax Forms Income Tax National Insurance Number

P60 Is Missing Then Don T Worry You Can Get Replacement Payslips Online National Insurance Number Number Words Income Tax Details